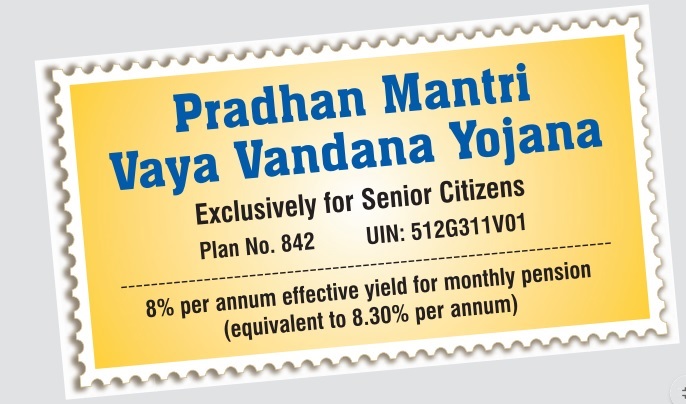

Understanding PMVVY Scheme

Designed by the central government and operated by the Life Insurance Corporation (LIC) of India, PMVVY is a pension scheme exclusive for senior citizens aged 60 years and above. Launched with the vision of secure senior citizens’ financially, the PMVVY scheme can be procured both online and offline. It operates with a policy term of ten years, providing those insured a regular pension for their survival, protecting the elderly from market fluctuations, and ensuring they have a regular income during their old age.

Key Features of PMVVY Scheme

Eligibility

As per the PMVVY scheme, the minimum age of entry is 60 years. There is no ceiling imposed on the maximum age of entry. Hence, every Indian senior citizen can avail of this scheme irrespective of their age.

Investment limit

The maximum investment limit of PMVVY has been set at Rs. 15 lakhs per senior citizen. This cap implies the pension would be a maximum of Rs. 10,000 per month or ₹1,20,000 per year based on your choice of pension mode.

Regular Pension

Unlike many pension schemes that offer only yearly pay-outs, the PMVVY scheme offers various pension modes monthly/quarterly/half-yearly or annually, based on the policyholder’s choice.

Locked-in Interest rates

One of the most attractive aspects of the PMVVY scheme is the fixed interest rates, locked in for the entire duration of policy, preventing any fluctuations in pension due to market downtrends.

Surrender Value

There is a surrender value applicable in case of emergencies. If the policyholder faces a critical/terminal illness (either for self or spouse), a provision is made to exit from the scheme prematurely, with 98% of the total amount paid as purchase price.

Loan Facility

After completing three years of this policy, the senior citizens are allowed to avail loan up to 75% of their purchase price, thereby catering to their sudden financial needs.

PMVVY and Health Insurance

Being primarily a pension-based programme, PMVVY isn’t technically health insurance; however, its popularity amongst senior citizens attributes to its role as a financial safety net. In the times of escalating healthcare costs, senior citizens often face the stress and strain of healthcare expenses. In such situations, the regular pension received from the PMVVY scheme can aid in managing costs without exhausting their savings.

While one cannot undervalue the importance of having dedicated health insurance in today’s world, having a reliable pension scheme such as PMVVY can provide financial stability and a dependable source of income creating a robust financial cushion in the latter part of life. Combining the PMVVY scheme with health insurance can offer optimum security and enhance the living standard for senior citizens.

To explore more about the PMVVY scheme and other financial products, you can download the Bajaj Finserv App here. The app provides comprehensive information and easy access to various financial services, ensuring that you can make informed decisions for your financial security.

Conclusion

In the sunset years of life, financial constraints should be the least of worries for anyone. The PMVVY scheme acknowledges this sentiment and aims to provide financial stability and independence to senior citizens in India. With its unique features and flexibility, PMVVY undoubtedly serves as a beacon of hope for senior citizens making their twilight years smoother and worry-free. It advocates for the combination of a pension scheme and health insurance to offer a comprehensive solution for elderly people looking forward to a relaxed and secure retirement.