Get the latest insights on price movement and trend analysis of Iron Ore in different regions across the world (Asia, Europe, North America, Latin America, and the Middle East & Africa). Iron ore, a crucial raw material in the steel industry, plays a pivotal role in global economic activities. Understanding its price trends and forecasts is essential for stakeholders navigating this dynamic market.

Request For Free Sample: https://www.procurementresource.com/resource-center/iron-ore-price-trends/pricerequest

Definition:

Iron ore refers to a mineral substance that is mined, refined, and used primarily to produce steel. It exists in various forms, including hematite and magnetite, each with distinct chemical compositions affecting its market value. As a commodity, iron ore is traded globally through established exchanges, with prices influenced by supply-demand dynamics, geopolitical factors, and industrial consumption patterns.

Key Details About the Iron Ore Price Trend:

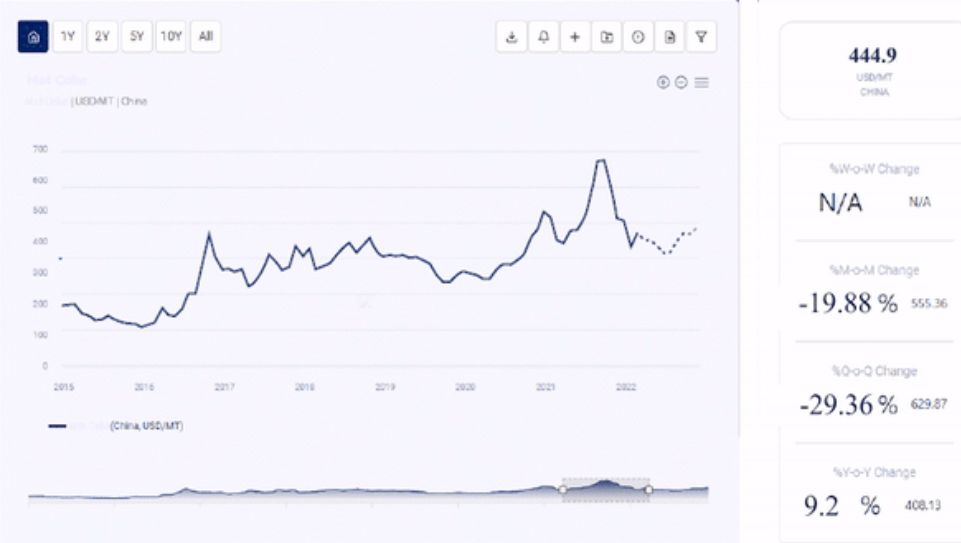

The price of iron ore exhibits volatility influenced by factors such as global economic growth, infrastructure development, and environmental policies. Recent trends indicate fluctuations due to supply disruptions from major producers, changes in steel production capacities, and shifts in global trade patterns. Understanding these trends helps anticipate market movements crucial for strategic decision-making.

Industrial Uses Impacting the Iron Ore Price Trend:

Iron ore serves as the primary raw material for steel production, contributing to infrastructure projects, automotive manufacturing, and machinery production worldwide. Demand fluctuations in these sectors directly impact iron ore prices. Additionally, technological advancements in mining and processing contribute to supply dynamics, influencing price stability.

Key Players:

Several global entities drive the iron ore market, including mining giants like Vale S.A. (Brazil), BHP (Australia), and Rio Tinto (UK/Australia). These companies dominate production and export capacities, impacting market supply and pricing strategies. Regional players and emerging market entrants also influence the competitive landscape, fostering innovation and market expansion.

Conclusion:

In conclusion, navigating the iron ore market requires robust insights into price dynamics, supply chains, and industrial applications. Procurement Resource serves as a valuable partner, offering comprehensive analyses and forecasts to optimize strategic decisions in iron ore procurement and utilization. Stay informed to harness opportunities and mitigate risks in this critical sector.

Contact Us

Company Name: Procurement Resource

Contact Person: Christeen Johnson

Email: [email protected]

Toll-Free Number: USA & Canada – Phone no: +1 307 363 1045 | UK – Phone no: +44 7537 132103 | Asia-Pacific (APAC) – Phone no: +91 1203185500

Address: 30 North Gould Street, Sheridan, WY 82801, USA